At Spring Global, we specialize in revolutionizing how consumer goods companies execute their go-to market in the field with innovative AI- and Machine learning-powered mobile and back-office solutions. Our cutting-edge technology empowers CPG companies to seamlessly integrate mobile platforms into their go-to-market operations, enhancing customer experience in the field and driving growth.

Get to Know Us and Our Solution

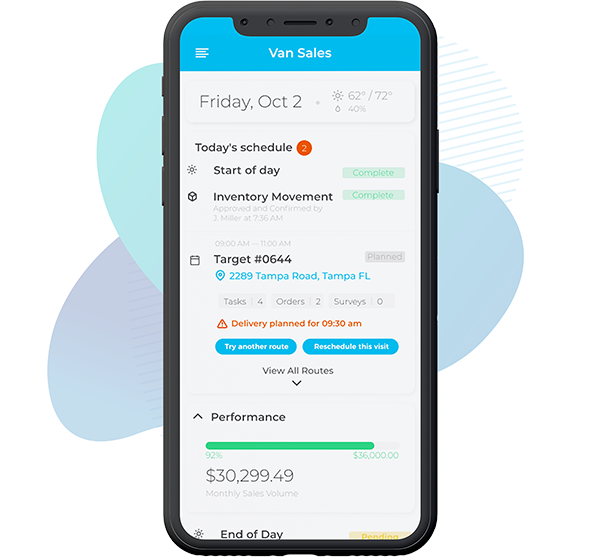

Request a DemoWhether it's developing mobile apps tailored to the consumer goods industry, optimizing mobile sales merchandising, and delivery strategies, or implementing mobile payment solutions, we are dedicated to helping consumer goods companies thrive in the digital age. With Spring Mobile Solutions, unlock the full potential of AI and mobile technologies to elevate your brand and exceed customer expectations.

A 360° View of the Customer

We’ve built our field sales tools to enable all users to have access to the customer data they need to ensure excellent customer service. Interactions between your teams are better supported because Sales Reps, Merchandisers, and Delivery drivers all have a single view of the customer.

“It’s been almost overwhelming when it comes to exposing the opportunities we have in the field…there are millions to be made!”

Beeland Nielsen, Vice President and CIO at Coca-Cola Bottling Company UNITED, Inc.

A Proven, Flexible Enterprise-Grade Solution

Spring has experience scaling to tens of thousands of users globally for CPG companies. Our reliable and highly customizable, configurable solution can handle specific, specialized needs. The solution natively supports multiple languages (including double-byte languages), currencies, and time zones and integrates seamlessly with your other solutions. As a Gold Microsoft partner, we deploy on Azure, enabling simple integration with other enterprise software, including SAP.

A Focus on Continuous Innovation

Our development team operates on a continuous delivery model, with new releases coming out every four weeks. Our solution has a modern, intuitive user interface, which users love, and continues to evolve and improve, based on customer feedback. Our developers and support teams make up over 85% of our entire company. The people who built your solution support your solution.

Easy To Do Business With

Our loyal customers, such as Unilever and Coca-Cola, will testify to our complete focus on customer service. We work closely with our customers on deliverables and timelines. When we make a commitment, we deliver on it. Our highly skilled professional services team will ensure that we design the right solution for your team, taking into account your business processes, and importantly, the environment your users work in. Our support team is highly responsive and understands your business in detail, so we prioritize and resolve tickets based on more than just an SLA. We make it our business to understand what is important to you at different times of the day, week, or month to enable us to do this.

Spring has a track record of success with high-profile clients.

See how we helped Coca-Cola increase its profitability and efficiency. View our Success Story video.